If you’ve ever tried to access your money and suddenly found your bank account frozen, you know how stressful it can be. Whether the freeze is due to KYC (Know Your Customer) issues, cybercrime investigations, overdue loans, or inactivity, it’s important to know exactly how to resolve the issue quickly.

In this guide, we’ll cover why bank accounts get frozen, how to unfreeze a bank account, and the trending legal updates in 2025 that every account holder should know.

🔎 Why Bank Accounts Get Frozen

Banks and financial authorities can freeze your account for several reasons:

-

KYC not updated – Expired ID proof, address mismatch, or incomplete documentation.

-

Suspicious transactions – Large unexplained deposits, sudden foreign transfers, or unusual activity.

-

Court orders or cybercrime reports – If your account is flagged in a fraud case or by law enforcement.

-

Loan default or tax dues – Non-payment of EMIs, government dues, or garnishment orders.

-

Dormant / inactive account – No activity for 1–2 years in savings accounts or post office accounts.

👉 Pro Tip: Regularly update your KYC and keep your transactions transparent to avoid future freezes.

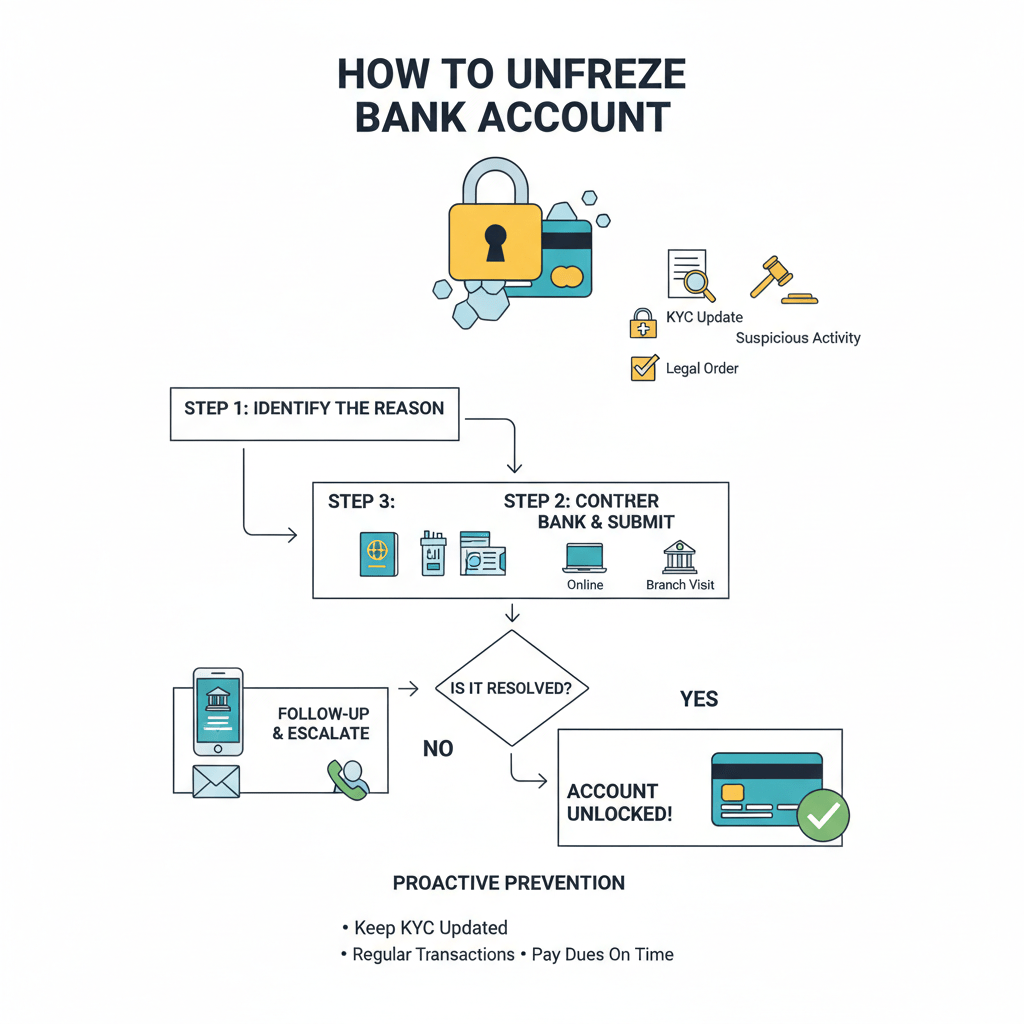

✅ How to Unfreeze a Bank Account: Step-by-Step

Here’s the general process to unfreeze your account in 2025:

1. Contact Your Bank Immediately

-

Visit your branch or call customer care.

-

Ask why the account is frozen and request a written explanation or reference number.

2. Submit Required Documents

-

For KYC issues: PAN card, Aadhaar card, passport, or updated address proof.

-

For dormant accounts: Re-activate with a small deposit/withdrawal + ID verification.

3. Resolve Legal or Cybercrime Freezes

-

If frozen by police or cyber cell: File a representation to the Investigating Officer with transaction proof.

-

If due to court orders or loans: Clear dues, settle with creditors, or approach the court for relief.

4. File an Application to Unfreeze

-

Some banks require a written request or “Unfreeze Bank Account Application.”

-

Include account details, freeze reason, documents attached, and request for restoration.

5. Escalate if Delayed

-

If the bank doesn’t act within 7 working days, escalate to the Bank Ombudsman, RBI, or court.

⚖️ Trending Legal Updates (2025)

-

Selective Freezing Guidelines – In cyber fraud cases, only the disputed amount should be frozen, not the entire account.

-

Court Interventions – High Courts in India have ordered banks to unfreeze accounts when freeze orders were arbitrary.

-

Post Office Accounts – Accounts inactive for 3 years will be frozen unless reactivated.

🛡️ How to Prevent Account Freezes

-

Update KYC documents regularly.

-

Keep small transactions active in dormant accounts.

-

Avoid suspicious or unverified transfers.

-

Respond quickly to notices from banks.

-

Keep loan/tax payments up to date.

❓ FAQs on How to Unfreeze a Bank Account

Q1: How long does it take to unfreeze a bank account?

👉 Usually 2–7 working days after submitting documents, but legal freezes can take longer.

Q2: Can the bank freeze my account without notice?

👉 Yes, in cases of fraud suspicion, legal orders, or KYC lapses. But they must inform you afterward.

Q3: What if my account is frozen due to cybercrime?

👉 File a representation with the police/cyber cell. If unresolved, approach the court for an order to unfreeze.

Q4: Can I withdraw money from a frozen account?

👉 No, you cannot transact until the freeze is lifted. Some guidelines allow withdrawal of undisputed amounts.

📌 Conclusion

A frozen bank account is not the end of the road—but the key is quick action. Contact your bank, provide required documents, and if necessary, seek legal help. By staying compliant with KYC, keeping your accounts active, and ensuring transparent transactions, you can avoid future freezes.

👉 If your bank account is currently frozen, don’t panic. Start with your bank branch, keep all documents ready, and follow the step-by-step guide above to unfreeze it smoothly.

⚡ SEO Keywords included: how to unfreeze bank account, frozen bank account, unfreeze bank account India, cybercrime bank account freeze, KYC frozen account, dormant account unfreeze, RBI guidelines account freeze.

Leave a Reply