A frozen bank account can create serious problems in daily life. When an account is frozen, salary credits may stop, UPI and online payments fail, ATM withdrawals get blocked, and even basic banking becomes impossible. In most cases, people come to know about the freeze suddenly, without any prior intimation from the bank. The most common reasons include incomplete KYC, PAN–Aadhaar not linked, suspicious or high-value transactions, inactivity, or compliance checks under banking rules.

If you are searching how to unfreeze a bank account in India, this complete guide by TopLegalHelp.com explains everything in a simple way. It covers why bank accounts get frozen, legal reasons under RBI guidelines and Indian law, the step-by-step unfreeze process, documents required, bank-wise solutions, and the time usually taken to restore the account. The guide also explains legal remedies available if a bank delays the unfreezing process. This information is applicable to major banks like SBI, HDFC, ICICI, Axis, PNB, Union Bank, Kotak, Yes Bank, Paytm Payments Bank, Jio Payments Bank, and more.

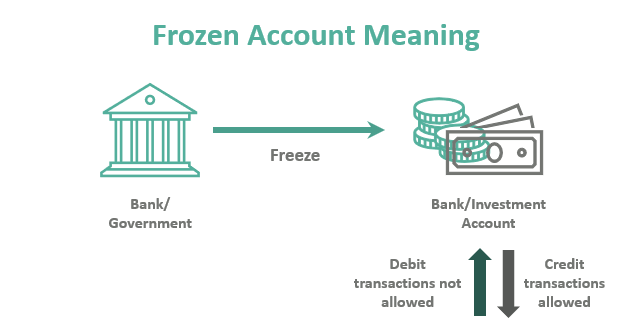

What Does “Bank Account Freeze” Mean?

When a bank account is frozen:

You cannot withdraw money

UPI & net banking stop

Debit card stops working

Sometimes even deposits are restricted

Banks freeze accounts to comply with RBI guidelines, Income Tax laws, PMLA (anti-money laundering) rules, or court orders.

Common Reasons Why Bank Accounts Are Frozen

1. KYC Not Completed (Most Common)

If your PAN, Aadhaar, or address proof is missing or outdated, banks freeze accounts.

2. Suspicious or High-Value Transactions

Large cash deposits, foreign transfers, crypto, betting, or sudden inflow/outflow can trigger AML checks.

3. Income Tax Notice

Accounts may be frozen due to:

Unfiled ITR

Mismatch between income & transactions

Tax recovery proceedings

4. Legal or Court Order

Police complaint, cyber fraud investigation, or court attachment.

5. Dormant or Inactive Account

No transaction for 12–24 months.

6. Linked to Fraud or Scam (Even Unknowingly)

If money credited is linked to fraud, bank freezes account temporarily.

How to Unfreeze Bank Account – Step-by-Step Process

Step 1: Identify the Exact Reason

Check SMS/email from bank

Login to net banking

Visit nearest branch

Call customer care

👉 Ask clearly: “Why is my bank account frozen?”

Step 2: Submit Required Documents

Depending on reason, documents may include:

For KYC Freeze:

Aadhaar card

PAN card

Address proof

Passport size photo

For Suspicious Transactions:

Transaction explanation letter

Source of funds proof

Salary slip / business invoices

For Income Tax Freeze:

ITR filing acknowledgment

Tax payment proof

Reply to IT notice

For Legal Freeze:

FIR copy (if any)

Court order

Lawyer representation

Step 3: Write an Application to Bank

Sample Application (Short Format):

Subject: Request to Unfreeze My Bank Account

Respected Sir/Madam,

My bank account (Account No: XXXXXXXX) has been frozen. I have submitted all required documents and complied with guidelines.

I kindly request you to verify and unfreeze my account at the earliest.

Thanking you,

Name

Mobile Number

Step 4: Follow Up Regularly

Branch visit every 3–5 days

Email bank grievance cell

Use customer care ticket

Step 5: Escalation if Not Unfrozen

If bank delays beyond reasonable time:

File complaint on RBI Banking Ombudsman portal

Send legal notice through advocate

Approach consumer court if needed

Bank-Wise Account Unfreeze Process (India)

SBI Bank Account Unfreeze

Visit home branch

Submit KYC update

Usually unfrozen within 24–72 hours

HDFC / ICICI / Axis Bank

Branch + online grievance

Transaction explanation required

Takes 2–7 working days

PNB / Union / Canara Bank

Manual verification

KYC + written request

Takes 3–10 days

Paytm / Jio Payments Bank

App-based KYC

Email support required

Legal freeze takes longer

Can Bank Freeze Account Without Informing?

Yes. Under RBI & PMLA rules, banks can freeze accounts without prior notice, especially in fraud or AML cases.

What If Bank Refuses to Unfreeze Account?

You can:

File RBI Ombudsman complaint

Send legal notice

Approach High Court in extreme cases

Take help from banking law expert

How TopLegalHelp Can Assist You

At TopLegalHelp.com, we help you resolve frozen bank account issues quickly and legally. We provide support for legal notice drafting, RBI Banking Ombudsman complaints, Income Tax notice replies, and court order–related account freezes. Our team also ensures fast and effective coordination with banks to avoid unnecessary delays.

📞 Call/WhatsApp: 8899811299

📧 Email: support@toplegalhelp.com

Leave a Reply